From Author Earnings:

Print bookselling remains artificially silo’d by country even today, for variety of legacy historical and logistical reasons. But by contrast, the global ebook marketplace is a seamlessly international one.

For authors, selling an ebook to a reader in a different country is just as easy as selling to a reader in your home country. Barriers to reaching an international audience no longer exist.

Today, with the click of a button, any author can start selling any title they wish simultaneously in 12 country-specific Amazon stores, 36 country-specific Kobo ebook stores, and over 40 country-specific Apple ebook stores.

As of yet, most of these non-English-language ebook markets are still fairly early-stage. But that’s not true of the four other major English-language markets outside the US. In those markets, too, as we’ll see, a substantial share of all new-book purchases has already gone digital. And, as we’ll also see, untracked, non-traditional suppliers make up a high percentage of ebook sales in those countries as well. Which means that these other digital markets have also been consistently underestimated and under-reported by traditional publishing-industry statistics.

. . . .

So this time, we rolled up our sleeves and basically went for the whole enchilada:

- The top five English-language countries

- The fifteen largest ebook stores

- 750,000 top-selling ebook titles, in all genres and categories.

- All of it calibrated against 700,000 points of raw, unfiltered daily sales data, from over 20,000 distinct ebook titles across all 15 stores.

When we were done, we were looking at the most comprehensive international picture of English-language ebook sales available anywhere.

. . . .

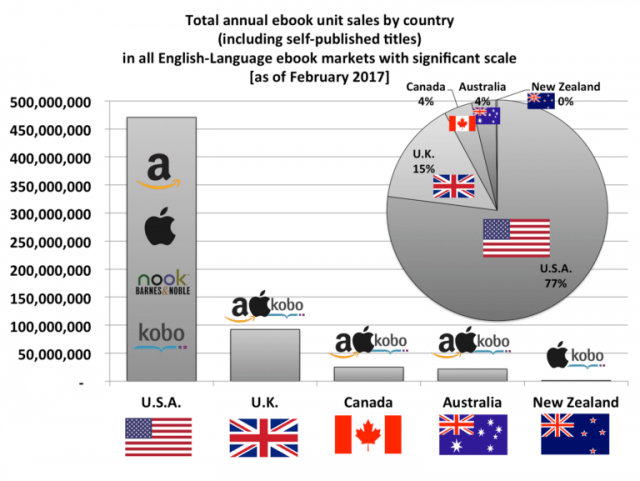

Population Reported

Print Book Sales

(annual units)Ebook Sales

(annual units)Ebooks as

% of

all book salesU.S.A. 325,700,000 675,000,000 487,298,000 42% U.K. 65,400,000 187,500,000 95,623,000 34% Canada 36,500,000 50,500,000 26,017,000 34% Australia 24,500,000 56,400,000 22,463,000 28% New Zealand 4,600,000 5,300,000 *1,306,000 20%* 5-Country Total: 456,700,000 974,700,000 632,707,000 39% . . . .

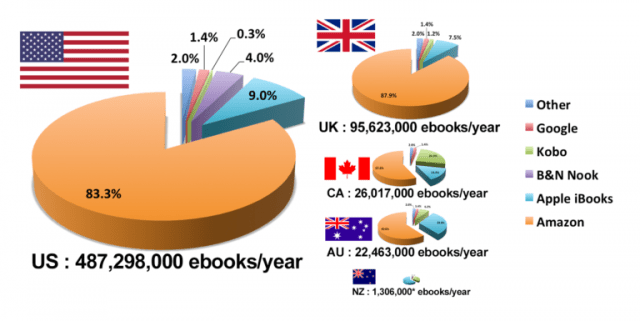

Amazon Apple

iBooksKobo Barnes&Noble

NookU.S.A. 406,000,000 44,041,000 1,246,000 19,395,000 U.K. 84,029,000 7,201,000 1,132,000 – Canada 14,892,000 3,760,000 6,479,000 – Australia 13,604,000 6,694,000 1,399,000 – New Zealand * 831,000 416,000 – 5-Country Total: 518,526,000 62,527,000 10,672,000 19,395,000 % of Total: 82% 10% 2% 3%

- Unsurprisingly, Amazon is the majority retailer in just about every market.

- But in Canada and Australia, Amazon is a lot less dominant than in the US and the UK.

- Taken all together, Amazon accounts for more than 80% of English-language ebook purchases, Apple another 10%, Kobo 2% and Nook 3%

- The remaining 3%–ascribed to GooglePlay and all remaining channels–is most likely overly optimistic. Their true share might well be even lower.

. . . .

- Self-published indie authors are verifiably capturing at least 24% – 34% of all ebook sales in each of the five English-language markets; it’s not just a US-only phenomenon. When you also include the uncategorized authors, the vast majority of whom are also self-published, the true indie share in each market lies somewhere between 30% – 40%.

- Indies are competing particularly well in the Canadian and Australian ebook markets, nearly approaching the level of dominance they currently hold in the US.

- The Big Five, on the other hand, are letting themselves progressively get squeezed out of nearly every English-Language ebook market. They make up only 38% of Canadian ebook purchases, and that’s the country where they are holding their ground best; in the US, the Big Five now account for barely 26% of all ebook sales.

- Amazon Imprints have made the most market headway in the US. Despite being single-retailer exclusive to Amazon Kindle, the dozen or so Amazon “house” publishing imprints between them account for 14% of all US ebook sales, 10% of all UK ebook sales, and 8% of Australian ebook sales. In Canada, the Amazon Imprint footprint is a much more modest 3% of all ebook sales, largely due to the substantial shares of the overall Candian ebook market held by Kobo (25%) and Apple (14%).

Link to the rest at Author Earnings

Amazons own imprints seem to be rising while others are plateauing or even falling. That can only mean that the indies who have given Amazon a monopoly on their books via select and KU are now in even greater competition with their only sales and revenue source.

Or it could mean they are joining the Amazon imprints. Amazon has to get the books from somewhere and we know several of the big Amazon proselytizers have been picked up by Amazon imprints.

But, yes, sub-midlister non-Amazon imprint indies might do well to reexamine the cost-benefits of going all in. It might still be the best option, but circumstances have changed.

When Amazon imprints take up more than half of the top twenty books in the most popular categories, that’s not market forces at work, that’s Amazon deciding what books will be there and what books will not.

So if you’re an indies author you have pressure from Amazon imprints on one side, combined with the suppression of FREE and other indie tools on the other, from the company that’s not only your biggest vendor but also your biggest paycheck. And as I already said; for many its their only vendor and paycheck.

Added to this I see that most of these Amazon imprints are priced in the $4.99 range. In order to compete, indies will have to price lower. It seems (to me) that indies are no longer being pushed into the $2.99-$9.99 bracket, but are now being herded into the $4.99 or less bracket.

Unsettling indeed.

I agree with you.

A crime-novels indie author quite succesful in France was picked up by Amazon for translation and publication. On the first translated novel they did a big push. They (a couple) sold a ton. On the second, insignifiant marketing from AMZ (why ? since the first was a success…). They sold not even one percent of the first novel numbers. I repeat : less than one percent of the sales from the first novel. Were the novels that bad ? No, the first had relatively good reviews, and a lot of them (like 1800), and it is still selling well two years after launch. The second has even better reviews, but only 29 of them…

So the weight of AMZ pushing your book is very, very important.

And they want to sell their books, and they (probably) also want to keep the tradpubs alive (as Data Guy says).

The worst part of that is under the Amazon deal the author only makes 35%. They are most likely locked into that deal and unable to make any changes to improve the situation either. Hopefully they can capitalize off the first book to help other books they write.

Not saying that all Amazon deals are bad, just that they are no different then a trade pub deal, and like a trade pub deal each author will have to crunch the numbers and decide for themselves if it is good for them and their career.

You know… this may not make a whole lot of sense, but bear with me:

How does Germany do with English-language books?

Now, this is counterintuitive, isn’t it? And maybe I’m just expanding on my own experience, as well. But Germany is a big Amazon market place, and I know a lot of people who prefer reading a book in English if that’s the original language. Or who love reading stories that haven’t been translated – often by indie authors.

And considering the population of New Zealand… Germany might be on par.

Would this be very hard to check? Just for a rough estimate?

The results for Australia are a tiny bit skewed because a lot of us were Amazon.com customers before the Australia-specific store opened, and didn’t make the switch to Amazon.com.au.

Back when I first started buying print books from Amazon, it was often the only place where I could find all of C.J.Cherryh’s work. Or Ursula K LeGuin’s for that matter. Sci-fi tended to occupy a very small section of most bricks and mortar bookstores, so it was Amazon or nothing.

Since the launch of the Aussie site, Amazon keeps pushing me to use the com.au store, but given that it offers only a limited range, I refuse to make the switch. I can only assume that I’m not the only one.

Niggles aside, the numbers are very interesting.

UK ebook unit sales are roughly equivalent to US ebook unit sales when measured against relative populations. Canadian and Australian ebook unit sales are roughly one-half what would be expected for their populations relative to the US. Both markets have a lot of potential to grow. If that rough doubling occurs solely by Amazon sales expanding, the relative strength of iBooks and Kobo in Canada and Australia would vanish.

iBooks and Kobo should put effort into maintaining relative market share in the smaller markets as they grow, because having an insignificant share in all markets is a much weaker position from which to try to grow.

So all the b*tching about KU and page flip and it turns out sales were down across Amazon all together. Or am I reading that wrong?

Hi, Jeff,

Overall Amazon sales actually went *up* by about 4% in 2016.

But between May 2016 and Oct 2016 Amazon *indie* sales dropped, not just for KU titles but for non-KU indie titles, too. (although they seem to be growing back now.)

I think what happened is that the indie share of Amazon sales was getting too ridiculous (closing in on 50% of all Amazon purchases). So Amazon decided to pull some algorithmic merchandising levers behind the scenes (in their nightly marketing emails, for instance) to start pushing traditionally published ebooks at customers more aggressively (traditional publishers would probably say, “more fairly” 😉 )

Which had the near-instantaneous effect of downshifting indies to 40% or so of Amazon US purchases in October, rather than the nearly half(!) of Amazon sales that indies had been grabbing in May.

Best,

DG

An honest question– Why would Amazon do that? Why would they care whether a book is indie or trad-pubbed? I can understand why they’d want to push their own imprints. Do they make more money from the overpriced trad-pub ebooks?

Hi, Kathlena,

As to Amazon’s motives, I can only speculate.

But I think that Amazon’s general business philosophy provides a pretty good guide to why they might do so: after all, most of their decisions are based on what they think serves Amazon customers best, rather than what serves their suppliers.

By putting a thumb on the scale to keep traditional publishers financially viable, Amazon ensures that Amazon can continue to offer their customers books from a wide diversity of supplier types, in the widest variety of formats.

Keep in mind that indie self-publishers aren’t (yet?) a significant supplier source for certain types of books. Deeply researched journalistic nonfiction, for instance, that requires years of travel and interviewing is often only made possible because a large traditional publisher pays a hefty advance for a book proposal. And peer-vetted scientific research similarly depends upon a variety of grant-funded publishing ecosystems that indies haven’t yet tapped into. Maybe indies will eventually move into those niches and dominate them, too, but until that happens, Amazon customers aren’t well-served by the collapse of traditional publishing.

Self-publishers also don’t yet do a lot of hardcovers, and many can’t afford professionally narrated audiobooks right out of the gate. Amazon customers as a whole buy a lot of both; traditional publishers still fill a lot of those needs, and their absence would impoverish title selection in both formats.

I think there’s historic precedent for Amazon tweaking their own sales mix to protect traditionally publishers from self-inflicted business wounds. I can think of at least two recent instances where Amazon reached deep into their own pockets to soften self-inflicted publisher damage from poor pricing policy decisions that otherwise would have severely hurt many traditional publishers’ long-term prospects for survival.

The first time was when Amazon discounted overpriced traditionally published ebooks down to breakeven on average, earning zero profit themselves and instead passing on to publishers a full 100% of the dollars consumers were spending on traditionally published ebooks.

The second time was when the biggest publishers fought for the right to prevent Amazon from discounting their ebooks, Amazon steepened their *print* discounts instead, giving up a big chunk of Amazon’s own margin on print to keep publisher print sales from collapsing as brick & mortar outlets shrank.

Of course, Amazon didn’t do either selflessly. In both cases, they served their customers better *and* grew their own market share. But I am almost certain that they don’t want to see traditional publishers die out, and today traditional publishers are so dependent on Amazon sales that it’s a very real medium-term possibility.

Best,

DG

Same question here. While it could be simply tradpubs buying “front table” space, that seems the only reason I can imagine it. Or, maybe, because Amazon makes more per unit if an ebook is 14.99 versus 2.99.

Any insights?

Amazon benefits from financially healthy suppliers.

Amazon can make more per sale on higher priced tradpub books if they restrain their discounting. Total revenue depends on number of sales, but tradpub is still moving a lot of books.

For the casual reading crowd a book still means a tradpub book. They might not buy many books each, but there are an awful lot of them. And each of those casual readers is as likely to buy a non-book product while at Amazon looking for the latest tradpub bestseller as are voracious readers. Getting customers into the store is a necessary first step in selling them something else.

Data Guy, These exploded pie charts make the presentation much stronger than the old pie charts.

Thank you, Antares.

It would be super great to get some book newsletter advertisers (aside from Bub) that really focused on gaining subscribers in those smaller markets and featuring books on the outlet that serves them most. Would love that!

I like that Kobo is doing so well; I like them as a distributor. It’s nice to see that the Zon, who I adore, has some competition. : D

Good fodder for the argument that writers should aim for books that appeal to Americans.

I was a little surprised to see Kobo’s share being so low. Maybe their new subscription service will help them gain market share.

That’s the “biggest share” system. It’s subject to positive feedback. It can pay off big, but it’s also not very predictable.

“When we were done, we were looking at the most comprehensive international picture of English-language ebook sales available anywhere.”

I thought AuthorEarnings.com simply *guessed* sales and revenue figures from Amazon?

In which case, if there is no actual hard data, then isn’t all this just wonderfully presented speculation?

Or does DataGuy now have actual data from Amazon, Apple, Nook, Kobo, and Google to play with now?

Not sure if you are joking????

http://authorearnings.com/methodology/

Data Guy never “guessed”.

The spider data has always been calibrated with actual sales numbers. The methodology is statistical in nature and has been refined over time with ever-increasing access to deeper data sets. The biggest change happened last year when he folded in print book data to provide context.

Tradpub apologists have gone from maligning his intentions to quoting him extensively.

His numbers are as good as any and better than most.

This comment reminds me of my favorite meme:

————————–

There are only two types of people

(Picture of Science Cat)

Those who can extrapolate from incomplete data

————————–

Author Earnings extrapolated this quarters results from 20,000 unique ebooks that they DID have access to, which accounted for 700,000 points of data. That is significantly more points of data than are used in Billboard’s radio tallies, when chart positions are determined.

Hi, Anthony,

It’s even better than that. 🙂

We used those 700,000 points of raw daily sales data from 20,000 unique titles to calculate to a high degree of precision the exact mathematical relationship between sales rank and cumulative daily sales in each store.

And then we applied that mathematical relationship to the sales rankings of 730,000 other best-selling ebooks to determine overall sales.

Best,

DG

For the super-geeks among us, here’s a graph that shows Kobo Canada raw (weighted cumulative) daily sales vs sales ranking in the Kobo Canada store:

http://authorearnings.com/wp-content/uploads/2017/03/kobo_ca_rank_2_sales_curve.png

Data Guy is such a tease:

“But keep in mind that our “Small/Medium Traditional Publisher” category lumps together many disparate types of publisher, from the smallest micropresses to the non-Big Five traditional giants like Houghton Mifflin Harcourt and Scholastic, from traditional university and academic presses to newer, digital-first publishers like Open Road Media. Not all of these different types of publishers that make up our “Small/Medium Traditional Publisher” category are seeing this rapid sales growth; in fact, quite the contrary.

We’ll save a more detailed breakdown of the Small/Medium Publisher category for a future report, but we’ll say this:

Almost all of the recent “Small/Medium Publisher” gains appear to be driven exclusively by one particular narrow subcategory of publishers, which is now seeing explosive growth in their ebook sales.

Hint: it’s not whom you think… :)”

Argghhhh!

Great report, otherwise. 😉

Hi, Felix,

I wasn’t trying to be deliberately mysterious about that; it’s just that I need to dig deeper into the data before I’m comfortable making definitive statements about it.

But this report had already taken roughly 15x as much effort as one of our usual Amazon-US-only reports (unfortunately, the level of effort to analyze each individual retailer in each country is roughly the same, regardless of how low its total sales contribution). It was so very long in the making that I just didn’t want to delay it any longer.

But now I’m dying of curiosity to break that red “Small/Medium Publisher” wedge into a few meaningful subcategories to see what we learn. 🙂

(Basically, I first need to spend some time categorizing the thousands of different publisher imprints in the “Small/Medium Publisher” category into smaller subcategories. And then I need to look at how sales have trended for each of those subcategories over the last 3 years worth of quarterly reports, to determine if this is a recent shift or a longer term trend.)

Best,

DG

Are you going to ask some of the SMP for info on their own websites?

For example, it’s not uncommon for Baen authors to earn out their advance before the publication date, just on the sales of the e-arc copies. While that’s a drop in the overall bucket, Baen started selling e-books last century and only added Amazon and B&N a few years ago

Interesting. Be even more interesting to see what happens to Amazon in Australia, where I am.

Currently I’m exclusive to Amazon, which on one hand seems counter intuitive… but I dunno. I know I’m also fairly pressed for time in my day to day life, so I don’t really want to complicate things by going wide. I’m also very green, so keeping it simple in the beginning makes sense.

A friend of mine goes direct to Amazon and lets Smashwords handle the rest. She figures it’s less aggravating that way.

Great stuff!