From Personanondata:

Attorney’s Sperling & Slater acting on behalf of three eBook buying plaintiffs are suing Amazon and the “big 5” publishers (Hachette, Macmillan, Penguin Random House, Simon & Schuster, Harpercollins) for eBook price collusion in the Southern District Court in Manhattan. These plaintiffs are deemed representative of the following class:

All persons who, on or after January 14, 2017, purchased in the United States one or more eBooks sold by the Big Five Publishers through any other retail e-commerce channel in the United States other than the Amazon.com platform.

The filing alleges that Amazon.com employs anticompetitive restraints to immunize its platform from the negative effects of the Big Five’s inflated eBook prices and that these ‘inflated prices’ are a result of the imposition by publishers of the agency pricing model.

There are several exhibits in this filing including the following:

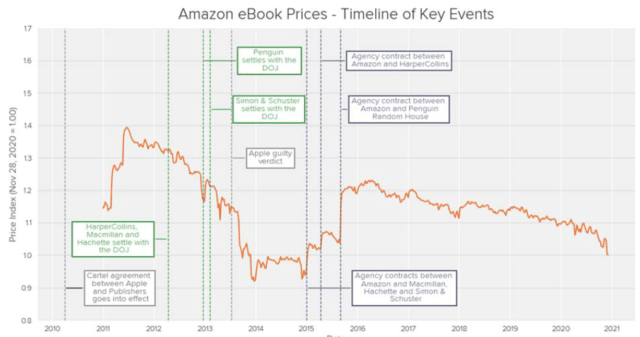

As the following chart shows,15 the Big Five’s eBook prices decreased substantially from 2013-2014, as long as the consent decrees prevented the Big Five from interfering with retailer discounts, but they immediately increased their prices again in 2015 after renegotiating their agency agreements with Amazon and have continued to maintain supracompetitive prices

.

What the above chart seems to be suggesting is that eBook prices from the big five are now at a level comparable to the 2014-15 time period which is when they were lowest.

In their argument the attorneys focus on the use of ‘most favored’ pricing models which Amazon requires of its vendors. Basically no other vendor (including the publisher) can offer better prices to consumers. Due to this according to the suit, Amazon removes any opportunity for price competition and therefore perpetuates higher (anticompetitive) pricing of eBooks. As follows:

27. Amazon’s and the Big Five’s continued anticompetitive use of MFNs in the United States is astonishingly brazen, given the DOJ’s high-profile enforcement against Apple and the Big Five in 2012 and the EU’s own proceedings against the Big Five and Apple in 2011 and subsequently against Amazon in 2015 for its own use of anticompetitive MFNs in eBook sales. Despite multiple investigations and censure, Amazon and the Big Five have engaged and continue to engage in a conspiracy to fix the retail price of eBooks in violation of Section 1 of the Sherman Act.

28. Amazon’s agreement with its Co-conspirators is an unreasonable restraint of trade that prevents competitive pricing and causes Plaintiffs and other consumers to overpay when they purchase eBooks from the Big Five through an eBook retailer that competes with Amazon. That harm persists and will not abate unless Amazon and the Big Five are stopped; Plaintiffs seek a nation-wide injunction under the Clayton Act to enjoin Amazon and the Big Five from enforcing this price restraint.29.Amazon’s conduct also violates Section 2. Amazon has obtained monopoly power in the U.S. retail trade eBook market, where it accounts for 90% of all eBook sales. Through its conspiracy with the Big Five Co-conspirators, Defendant Amazon has willfully acquired its monopoly power in the U.S. retail trade eBook through anticompetitive conduct, fixing the retail price of trade eBooks and causing supracompetitive prices for eBooks sold by or through Amazon’s eBook retailer rivals. Such conduct is an abuse of monopoly power in violation of Section 2 of the Sherman Act.

Link to the rest at Personanondata

Trigger Warning: Those susceptible to any adverse reactions or consequences as a result of reading an extended opinion of PG should stop reading NOW.

If such persons take the risk of reading further, they should notify a relative or friend that an intervention may be necessary to pull them back to some semblance of sanity following their consumption of an excessive dose of PG.

You Have Been Warned!!

Love and Kisses, Your Buddy,

PG

XXOOXX

First, some language clarification. As used in legal parlance, especially in antitrust matters, “MFN” refers to Most Favored Nation clauses.

The term, Most Favored Nation has its origin in international trade and tariff negotiations.

From The Balance:

Most-favored-nation (MFN) status is an economic position in which a country enjoys the best trade terms given by its trading partner. That means it receives the lowest tariffs, the fewest trade barriers, and the highest import quotas (or none at all). In other words, all MFN trade partners must be treated equally.

Link to the rest at The Balance

While international trade agreements are, at least generally, not subject to lawsuits in US courts, at some point in time, US (and perhaps other nations’) antitrust lawyers borrowed the MFN term and applied it to describe a concept in antitrust law:

From Practical Law Company:

Most favored nation clauses (MFNs), sometimes also referred to as

most favored customer clauses, are agreements in which a supplier

agrees to treat a particular customer no worse than all other customers

(see Standard Clause, General Contract Clauses, Most Favored

Customer (www.practicallaw.com/8-510-7389)). Under most MFNs,

a seller agrees to provide a product or service to a buyer at a price no

higher than the price it provides to any other buyer, now or during the

term of the agreement. Contracting parties commonly use MFNs to:– Reduce uncertainty about potential price fluctuations.

– Transfer risk of opportunism.

– Reduce the transaction costs of both initial and later bargaining.

While commentators and courts have found MFNs to be

competitively benign in most circumstances, recent actions and

comments by enforcement agencies have raised the possibility

that MFNs may be found to be anticompetitive in several specific

situations. This Note surveys those developments and discusses

some of the risk factors that a company should consider when

analyzing the legality of specific MFNs.

Link to the rest at Practical Law Company

Back to Amazon and Big Publishing.

Long-time visitors to TPV will recall that, in 2012, an antitrust case, United States v. Apple Inc., was filed by the U.S. Department of Justice against Apple Computer and five of the six largest traditional publishers in the United States.

The suit alleged that the six defendants had violated the US antitrust laws by agreeing to set fixed prices for e-books and force Amazon to sell e-books at those prices, which were higher than the discounted prices Amazon was then charging for Big Publishing’s ebooks.

Top executives of Big Publishing had been meeting secretly for some time to decide how to keep Amazon from selling their books at a discount. Apple was planning the launch of the first iPad and the opening of its iBookstore to sell ebooks and didn’t want Amazon to offer ebooks for discounted prices.

At the iPad launch, when Apple CEO Steve Jobs was asked by a Wall Street Journal columnist how the iBookstore was going to compete with Amazon when Amazon was going to be offering ebooks for lower prices, Jobs assured the columnist that the ebook prices would be the same on Amazon as they were at the iBookstore.

Such collusive price-fixing was and is, of course, wildly illegal under US antitrust law. In PG’s transcendently-humble opinion, only rank stupidity on the part of publishers and complete arrogance on the part of Apple’s highest execs can be concluded from such a stupid move.

PG is acquainted with some attorneys who work or have worked for Apple and is confident that if Apple execs had consulted inside or outside counsel, they would have been informed that it was a dumb thing to try and had a high probability of being slipping out into the light in one way or another.

Shortly after the suit was filed, each of the publishers caved, paying a fine and agreeing never to fix ebook prices again. Apple fought the matter and lost in the trial court, the US Court of Appeals and the US Supreme Court.

With that overlong background, now we find Amazon being accused of conduct similar to Apple, in company with the same group that got into trouble with Apple.

PG’s initial reaction was that Amazon would be too smart to fall into any sort of antitrust trap of the same general type that caused Apple embarrassment and money about 9 years ago. Why collude with convicts? (that’s a little over the top, nobody went to jail)

PG hasn’t had a chance to read the Complaint in this case in any detail, but it appears that counsel for the plaintiffs is focused on Amazon’s requirement that it receive the best price that the publishers offer anyone else for ebooks it licenses. Plaintiffs’ counsel also draws a specific parallels between what it alleges Amazon’s behavior to be today and what Apple’s was in former days.

In the former antitrust case, the publishers were threatening to cut off access to their products for Amazon if it didn’t raise its prices.

PG’s has not read anything about the present claims that suggest that competitors to Amazon are being forbidden from discounting their ebooks below Amazon’s prices.

Nothing in the idea of a free market guarantees that everyone is entitled to a profit on any sale. If a competitor of Amazon wishes to acquire ebook licenses from major trade publishers and chooses to resell licenses for less than it paid for them as loss leaders in order to capture market share, there is no harm to consumers because they’re given the choice to purchase a given title at a lower price than they can from Amazon.

Amazon was reported in past times to have engaged in such discounting for various products in exactly that manner – attracting customers to its store by selling some products at a loss in order to sell other things to a customer at a small profit during the same visit or later visits when the customer returned to purchase things from Amazon.

There is a distinction between Amazon requiring that large publishers sell ebook rights to Amazon at a price that is equal to the best price the publishers offer anyone and Amazon requiring that publishers somehow force others to sell ebooks at a price no lower than Amazon sells them.

PG has digressed too long in speculation, however.

One point PG hasn’t seen mentioned anywhere else is that Amazon offers a wide range of much lower-priced ebooks from indie authors.

Forget about traditional publishing. Lots of readers enjoy buying high-quality ebooks from indie authors on Amazon because indies are willing to price their books lower than New York or London corporate publishers are.

Some buyers may also be aware that, when they buy books from indie authors, a much higher percentage of each dollar they spend on Amazon ends up in the author’s pocket than if they buy a book from a traditional publisher.

PG would argue that looking at what has happened to the ebook prices of traditional publishers with their excessive cost structures and obligations to kick lots of money upstairs to their often privately-held overseas owners is only looking at the portion of the ebook market that is in slow decline.

The growing market for indie ebooks notwithstanding, if, as one of the OP’s claims, if Amazon is using:

“‘most favored’ pricing models which” prevent any “other vendor (including the publisher)” from offering “better prices to consumers.

PG has no sympathy for Amazon and hopes it is punished for such activities.

If, on the other hand, Amazon is using its power to control its costs only (not the amount that competitors can charge for an ebook), Amazon is requiring that it be given the right to sell ebooks while paying the publisher a price that isn’t higher than the publisher is charging a competitor of Amazon to sell the same ebook, then Amazon is not demanding an uneven playing field.

In such case, Amazon is demanding a flat field, an equal cost basis upon which it it can set its own retail prices just as a competitor of Amazon can set its own retail prices.

In such case, Amazon is not saying, “You have to force any other ebook retailer to not underprice Amazon.”

Again, PG isn’t opining about the full range of ways Amazon may be accused of violating antitrust laws.

Amazon as the overwhelmingly largest seller of ebooks in the US is subject to antitrust restrictions different than Amazon as a scrappy little online bookseller.

For the record, PG is not saying that Amazon can do no wrong. Earlier in Amazon’s history Jeff Bezos was fully hands-on with a smaller company and he was able to know most of what was happening inside a smaller Amazon.

These days, a post-divorce/new girlfriend Jeff Bezos has reportedly handed off a lot of day-to-day management responsibilities to others.

While PG would like to believe that the corporate culture that Bezos impressed upon Amazon during the early and middle part of its explosive growth still governs the operations of the company, he realizes that those handling the day-to-day business decisions for the company may be motivated by other incentives.

PG has personal experience with the vast changes that can occur in an organization when the management who hired him was replaced by management with a much different outlook on business life.

Viz the abolition of the UK Net Book Agreement:

“That lone voice [of dissent] belonged to the heroic John Calder, publisher of Beckett, William Burroughs and Henry Miller, among others. Calder branded the Publishers Association “craven, foolish, ignorant, suicidal” for failing to fight against the ruling. He predicted that independent traders would quickly start to go under, then that the large chains who had advocated the destruction of the agreement would start to fail too and then that publishing would be in a hell of a mess. He was right.

Maher [CEO of Dillons book stores], in contrast, had claimed that independent booksellers would remain “in good stead”. He said that abolition would “widen the market for almost all kinds of book”. He thought bookshops would benefit from “secondary purchases” even if they made less on the books that they had to discount. He was wrong.”

Dillons bookstore chain sold to Waterstone’s bookstore chain in 1999.

I note that there is no reference to the UK’s former Net Book Agreement — and variations thereof in various European countries (which are still in place in one guise or other). https://www.theguardian.com/books/booksblog/2010/jun/17/net-book-agreement-publishing

I also note that there is no reference to the UK’s Public Lending Right https://www.bl.uk/plr/about-us — in part introduced as a financial sop to ameliorate the impact of the ending of the NBA.

Poetically, the major bookshop chains that pushed for the ending of the NBA have gone to the wall.

And, why should the OP and PG refer to such — the OP is about the current state of book selling in the USA? Ask the question — how did it get here?

Well…consider this, while bookshops in the USA are not faring so well, more than 20 new independent bookshops have opened here in Catalunya over the past year — https://www.theguardian.com/world/2020/dec/27/in-a-year-of-forced-solitude-barcelona-rediscovers-the-companionship-of-books — (bookshops here, as in France, are considered essential cultural services and, as such, have remained open during lockdowns — except at weekends(!!!). And, in the UK, sales of books in 2020, by both volume and price value, was up by 5.5% over 2019 — the largest volume rise in book sales since 2007.

It is, as ever, a question of cultural values.

The reason for a would-be plaintiff to reach for anti-trust law indicates a lack of trust — in both commerce and government. A lack of trust fueled by a fundamental lack of shared cultural values.

More: https://www.thebookseller.com/news/rosewell-outlines-shape-new-net-book-agreement-605871

I am not sure I agree with the categorization of the OP, PG or the comments on MFN treatment, although we all end up in about the same place.

Obviously, Amazon is not going to say their MFN is designed to prevent competition. They’re going to argue, and partly rightly and partly wrongly, that what it is designed to do is make sure there is universal information n the market place and people can make informed decisions without having to search everywhere to find out that some backroom deal is giving a sweetheart price to Store X this week. They will wrap that argument in the same zeitgeist that goes with the one-click payment process patent/trademark attempts, their history of discounting wherever possible, etc. And they will paint it as no more than the equivalent of every retail outlet that offers “price matching” guarantees at the front end by ensuring that publishers offer it at the back-end.

I do think though that the OP is missing two very critical elements.

First, that chart shows that even with MFN, the sellers have slowly lowered the prices from 2017 to now, in the same way that Amazon’s discounting did by itself in the 2011-2014 period. It’s pretty hard to argue there’s no competition on pricing when the prices are being driven down (at least according to the chart). They may point to the precipitous jump, but that was the company’s decision to raise prices as they are allowed to do, and will be all about how they fixed the pricing structure for ebooks (i.e. that all books carry all the overhead costs, not just hardcover carrying hardcover, PB carrying PB, etc.).

Second, far more importantly, they don’t have Amazon’s internal data. So what will Amazon do? They’ll go way farther than PG did, and drown the opposition in internal data that shows that they have pushed for small independents to thrive, bloom, and flourish, the SME to the rescue while those staid old Big 5 sit and languish, AND they’ll be able to show the decreasing market share of the mainstream while the gigantic increase by indies over a longer period of time. Capitalism is alive and well and living in Amazon Marketplace.

The complainants might have a shot in a DoJ investigation but in open civil case? I have my doubts. In a civil case, BOTH sides get to set the narrative, and Amazon hasn’t played hardball with anyone publicly yet. The litigators are serving up fluff balls and Amazon will descend with mountains of data and a ton of lawyers. I don’t see this contest even being close. Unless you think Amazon might use this opportunity to throw all the Big 5 under the proverbial bus. 🙂

P.

PG is entertaining, always, and polite and restrained in discussions. And clear to point out when he agrees or disagrees with a quoted post.

The ADS clan, however, is rabid at times, and rigid the rest of the time. They don’t have to buy from Amazon if they don’t want to.

Trigger warnings are not necessary; possibly, instructions to bring popcorn may be.

I don’t see how it affects people that Amazon exists or doesn’t, and, for me as a disabled person, it is delightful to be treated exactly the same as everyone else, as a customer and as an author. I haven’t found that in other stores, online or RL. And no, I don’t always buy from them.

One of the undervalued elements of KDP’s online operation is it doesn’t know or care who you are or what you are. If you have a book and a bank account you’re good to go.

Every time somebody pops up with a gripe or wishful thinking about changing the culture of NY publishing I end up at the same place: why bother?

Let them be what they are and go take care of your own business elsewhere.

Live and let die.

A problem here is that for the ebooks in question, Amazon isn’t setting the price at all. Randy Penguin can cut a given ebook price, provided Amazon gets that price. the only thing I can see is that MFN means that a competitor to Amazon cannot undercut them and thus attract new business. That being the case, nobody tries to do so.

IANAL – What am I missing?

Dave, the problem is that MFNs by their nature inhibit (do not prevent) intentional price competition. Instead, they result in a purely reactive stance, which looks like this:

A, B, C, and D (product/service providers — what might be left after S&S is bought out if it is) all have MFNs with both V and W (actual vendors — illustratively only, Baker & Taylor and Ingram). C chooses to increase its long discount offered to W as part of a promotion — let’s say it’s part of a promotion for National Library Week. The MFN forces C to increase its long discount to V at the same time, even if V has less than 2% penetration into the library market and no interest in doing so. Meanwhile, A, B, and D twiddle their thumbs waiting for V and W to come and demand the same long-discount concession… which, due to the way the MFN is written, they will be obligated to give.{1}

Notice that in this scenario — which is the default for what happens in practice — all but one actor is purely passive; existing contract terms force “compliance.” That isn’t competition as antitrust law conceives of competition (not even under the Chicago School’s “consumer welfare is the only thing that matters, and price is the only thing that matters to consumer welfare” meme that is completely inapplicable to nonfungibles like books). And that’s why the MFNs are being attacked.{2}

Absent the MFNs, one can imagine more competition between V and W on both price and nonprice bases for C’s works, related to but technically independent from D’s works. For example, V might offer a slightly greater long discount… offset by W’s offer of noncosted emphasis in referral algorithms to disproportionately favor C’s works over D’s. With MFNs, though, that can’t happen, or at least it doesn’t due to the weight of complying with the MFNs under other circumstances. (This gets very, very complicated in managerial-spreadsheet-land very quickly, to the point that no competent academic accountant will ever issue an opinion on “proper share value” of a company subject to broad MFNs without huge reservations and qualifications.)

And that’s why MFNs are problematic, although not necessarily unlawful. They only inhibit, they don’t prevent, price competition, because they distract from or foreclose other mechanisms. They can, in combination with other factors actually foreclose price competition, especially when broad and/or combined with other aspects of market power; that’s precisely why the remedies eventually imposed in US v. Apple barred their use for several years. (Hint: They’re baaaaaaack…)

{1} If you’re wondering how this relates to authors, keep in mind that this is exactly how high-discount clauses negotiated in the 1980s and early 1990s resulted in all sales to Amazon being high discount. It was not only predictable, but there was substantial work (on pricing of traded options “close to the money”) in the 1980s that predicted not only that it would happen, but approximately when.

{2} Remember, too that MFNs originated in international trade treaties during the nineteenth century regarding critical defense commodities — never finished goods, never with entirely private actors as parties on both, or often either, side. That is, MFNs are from a mercantilist and not a free-market economy.

I think I need a fuller explanation of your first example. I understand that when C gives better terms to W it is also forced to give them to V. What I don’t understand is how the MFN terms require A, B and D to also give better terms just because C has done so. Has A, for example, written an agreement with V where it not only says that it will give V the same terms as W but that it will “price match” B, C and D? If so, why would it do this (I mean as a contract rather than as a result of competitive pressure)?

Also, the examples of MFN in both PGs comments and in general seem to be referring to the wholesale prices charged by the suppliers (which would be like the publishers having to sell to Amazon at the lowest price they offer anyone else), but the complaint seems to refer to the impact on the retail prices being set by the publishers. Does this difference matter?

Mike this is one of those “actual practice differs from theory” things. In theory, a minimal MFN would not force A, B, and D to align with C. In practice, the actual clauses are not minimal, and do. Further details are inside of various discovery bars for me (primarily in settled matters and/or in which I was consulted as a potential expert witness)… but are clearly indicated in Judge Cote’s thoughtful opinion in U.S. v. Apple.

It’s an admirable opinion because it goes “just far enough” in the factual findings to make reversal on appeal extremely unlikely. She bends over backward to avoid saying, as to specific factual assertions by the publishers and Apple, that they had set everything up in the classic “only a knowing wrongdoer trying to avoid liability would do that!” way. That said, her credibility determination (and remember, she’s seen all of the prior filings and papers in this lawsuit, which means she knows a lot more than any jury does) is rather telling:

“With respect to the MFN, Apple asserts that its sole intention in crafting that provision was to protect itself from price competition. It highlights the MFN’s function in lowering consumer-facing prices, not raising them, and claims this fact undercuts any inference that the provision was intended as a mechanism to compel an industry-wide shift in price upward. But, just as Apple had multiple motivations in its negotiations, there was more than one function for the MFN. The MFN did lower the prices in the iBookstore below the price caps set in the tiers if a Publisher did not immediately move its other resellers to an agency arrangement. As described above, however, for that very same reason the MFN also forced the Publishers to convert all of their e-book distribution arrangements to agency arrangements and to raise e-book prices. Otherwise, a bad economic arrangement became a disastrous one for the Publishers. That is why Apple labeled the MFN an “elegant” alternative to its initial demand that the Publishers move all of their e-book retailers to an agency model. Without that explicit requirement, Apple achieved the same end by means of the MFN.”

U.S. v. Apple, 952 F.Supp.2d 638, 701 (S.D.N.Y. 2013) (Cote, J.) (linked above; footnotes omitted); see also id. at 672 n.38 (“Neither Sargent nor Cue was credible during the trial when they denied that Cue had explained at dinner that Macmillan was required to put Amazon on the agency model.”) Perhaps most relevant, and damning, is Judge Cote’s footnote 66 (id. at 703):

“This Opinion has already described several instances in which testimony given by Cue and Sargent was unreliable. Other witnesses who were noteworthy for their lack of credibility included Moerer, Saul, and Reidy. Their demeanor changed dramatically depending on whether Apple or the Plaintiffs were questioning them; they were adamant in denials until confronted with documents or their prior deposition testimony; instead of answering questions in a straightforward manner, they would pick apart the question and answer it narrowly or avoid answering it altogether. Thus, the findings in this Opinion are informed by the documentary record, the circumstantial evidence, including an understanding of the competitive landscape in which these events were unfolding, and that portion of each witness'[s] testimony that appeared reliable and credible.”

This may seem tangential, but it’s really not… because believing the publishers on this would require believing that they’ve changed since, and many of the same executives remain in charge both there and at various vendors. Leopards are more likely to change their spots than are MBAs.

CE, thanks for taking the time to further my education.

As a consumer who is pretty much tied to Amazon’s ebook ecosystem (not permanently of course as I can always strip DRM and convert to epub, but I find it convenient) I do like the idea of arrangements that allow Amazon to price match so I’m not paying more than I would if I bought elsewhere.

However, I may be deluding myself as the big price differences I notice are the variations with time within Amazon’s system – it’s common to see a book on sale at 99p (or 77p) and realise that I paid the undiscounted price a few days or weeks ago.

IANAL – What am I missing?

Amazon’s MFN prevents a producer from cutting prices at the margin. For example, if he sells 100 books each year, he can’t cut price on the ten he sells at XYZ, while leaving the other 90 at his list price.

“But, he can cut price at XYZ anytime he wants.” Correct, but he can’t leave the other 90 at list price because Amazon kicked them off its site.